Travel Budget

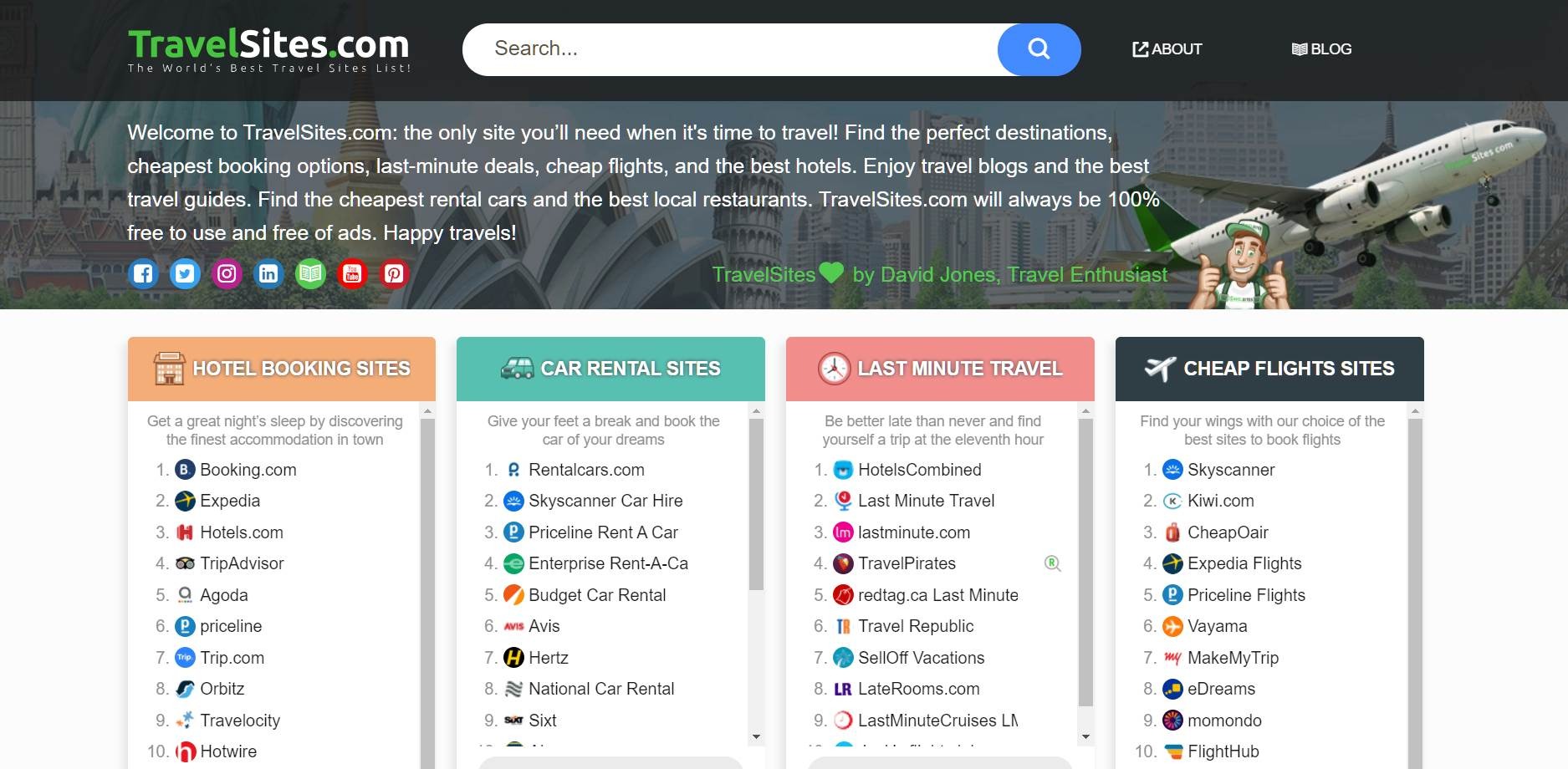

Keeping on top of all your finances when travelling can be as an important part of a trip as any. For many, the prospect of running out of money midway through can be unthinkable, particularly if you have an itinerary of things you would like to see. Or, less extreme, the idea of spending far more at the beginning of your travels than you would have liked and having to be careful throughout the rest of the trip, meaning you don’t enjoy yourself as much as you could have. Unfortunately, most travel plans are centered around money, meaning managing your finances is a vital factor to consider for any type of excursion, be it a weekend break or a year-long tour around the world. Luckily, there now exists a variety of different websites and smartphone apps that will help you stay on top of your spending, create budgets, send money and avoid pricey exchange rates. Not only are many of them free, they offer an easy way to become a expert when it comes to your own finances, without having to consult an advisor or gain a degree in Economics.

Bearing all this in mind, we have assembled a list featuring a selection of the eight most useful traveler finances platforms, be it a smartphone app or website. No longer will you have to worry about overspending or wondering how you will be able to send money to someone with a foreign bank account without having to pay excessive service fees. This list contains only the most genuine and helpful platforms for all things money-related that was put together by taking into account a range of factors to ensure that only the best were selected. Each one was thoroughly assessed, with each review containing a brief summary of the service, its highlights, what makes it unique and its potential drawbacks, while the pros and cons of each one are listed in an easy-to-read set of bullet points below each review. There are hundreds of platforms out there, all promising to offer help with traveler finances, however we’ve chosen only the ones that most suitably fit our criteria by considering a number of factors outlined below.

Considering the user interface and how easy the platform is to navigate is always an important part of the review process, regardless of the service being offered. A good, user-friendly interface with simple aesthetic is an obvious, yet often underrated, aspect of many websites, and something that can ultimately influence the entire experience for customers looking to manage their finances. While a website may offer a vast array of options and added features, an overcrowded and confusing homepage can make using even the platform’s most simple function difficult for many users. Frequently, the best sites are those with a simple, minimalistic aesthetic that make no attempt to over complicate the service offered by adding too many extra features, while they also seem to be the ones with the fastest loading speeds. Those that have an abundance of pop-up adverts and promotions can also make searching for information a more stressful experience than it ought to be. Therefore, we made sure that, when reviewing the various traveler finances platforms, we considered the overall usability and how easy it was to find what you were looking for before going on to assess any other factors.

While many of the traveler finances platforms included in the list are smartphone apps only, we also looked to assess whether any of the websites offered a mobile application as well. As travelers are typically always on the move, it is important to factor in that they will not always have access to a desktop computer, sometimes for up to months at a time. However, one item most people will carry around with them, no matter how Ludite, is a smartphone, be it for taking photographs, checking the time or sending the occasional Whatsapp to family back home. If a website also offers an downloadable application, therefore, it means that they will be able to continue using the platform’s content, regardless of whether there are computers available or not. A quick stop over in a cafe or even dipping into data roaming will allow users to sort out any money-related matters they may have, before carrying on with their trip, free of any overhanging financial worries. Expensify, an online expense tracker, is one example of a platform that can be accessed both via a desktop or a free smartphone app, making it much more versatile than platforms that have similar features yet are only available as one or the other. For that reason, we made sure to factor this into the review process to ensure that we were suggesting only those services that made keeping on top of finances easy at home, as well as one the move.

Although maybe not as essential as simple navigation or good aesthetic, yet still a feature worth taking note of, was whether the traveler finances platforms offered a blog. Blogs can be fantastic resources for providing useful articles on money-related topics, from how to manage a budget while abroad to avoiding exchange rate fees applied by banks. Goodbudget is a great example of a platform that offers this type of information, not just with a blog but also with its podcast, which supplies a whole range of insightful content that can be downloaded for free and listened to while on the go. Visa Travel Services is another platform that provides its users with free travel tips, with its ‘Travel Protections’ section featuring valuable security tips laid out in an easy to read bullet point format to help make a safe trip regardless of the destination. Therefore, when reviewing the various traveler finances platforms, we ensured that we assessed the presence of a blog as this would make the service more comprehensive.

Finally, we looked at whether the platforms had in place an email notification system to alert their customers on updates in their financial situations. Alerts sent straight to your inbox can be a great feature as they mean you are consistently up to date, regardless of whether you remember to open the app or visit the website to check. Mint is an example of a service that notifies its users if it spots any irregularities in their finances, such as going over budget or being charged for things you haven’t agreed to pay for. This differs from traditional methods of looking after your budget, in which you may not have noticed if you were being charged for something until it was too late. TransferWise, meanwhile, ensures that it keeps its customers updated on the status of their transfers so that they can quickly fix any problems should they arise. Clearly, this is a very useful and simple feature to have in place, yet can end up saving users time and trouble, as well as money, meaning they were factored into our review process when compiling the list.

Overall, this list provides a selection of the eight most useful traveler finances platforms, carefully selected from hundreds of similar services. Keeping on top of financial matters while travelling is not always the top of the list of things to do, however it is undoubtedly an important and deciding part of any trip, no matter how short. Manage your finances, send money, get email alerts straight to your inbox and much more, all by simply referring to this carefully curated list. We have taken into account the aforementioned factors to provide you with only the most genuine and useful platforms for all money-related matters, meaning you won’t have to worry about overspending ever again.