Dollarbird

dollarbird.co

Dollarbird is a calendar-based personal finance management service that allows users to add past, future or recurring transactions and categorise them with the help of AI. They offer a free smartphone application as well as a desktop website, meaning you can keep track of everything while on the go. Customers are given the choice between three different packages: Free, Pro and Business, with Business allowing unlimited calendars and unlimited team members.

Dollarbird differs from other budgeting apps inasmuch as it uses a calendar system to track spending, rather than by dividing it into different categories. The platform doesn’t allow you to input your bank details, instead requiring you to enter data manually, which can be slightly long winded, however an overview of your spending can be easily viewed via the dashboard. I particularly like the calendar feature as it presents all your expenses in a minimalistic style, which makes it more simple to navigate than other similar apps, such as Mint.

Another benefit to the service is the price. While the free version is more than adequate for a single user, the Pro version is priced at just $3 USD per month, including features such as an advanced collaborative option for partners, families and freelancers, which incorporates 20 calendars.

Nevertheless, a downside to Dollarbird is lack of a budget-setting capability. This means that while you are able to look over your expenses in an aesthetic format, you cannot set targets for spending, a feature that often appeals most to those using budgeting platforms.

Furthermore, the customer service is rather difficult to get hold of, with just one option of ‘Submitting a request’ to get in contact with the administrators. The addition of a phone number or online chat would make the app more complete.

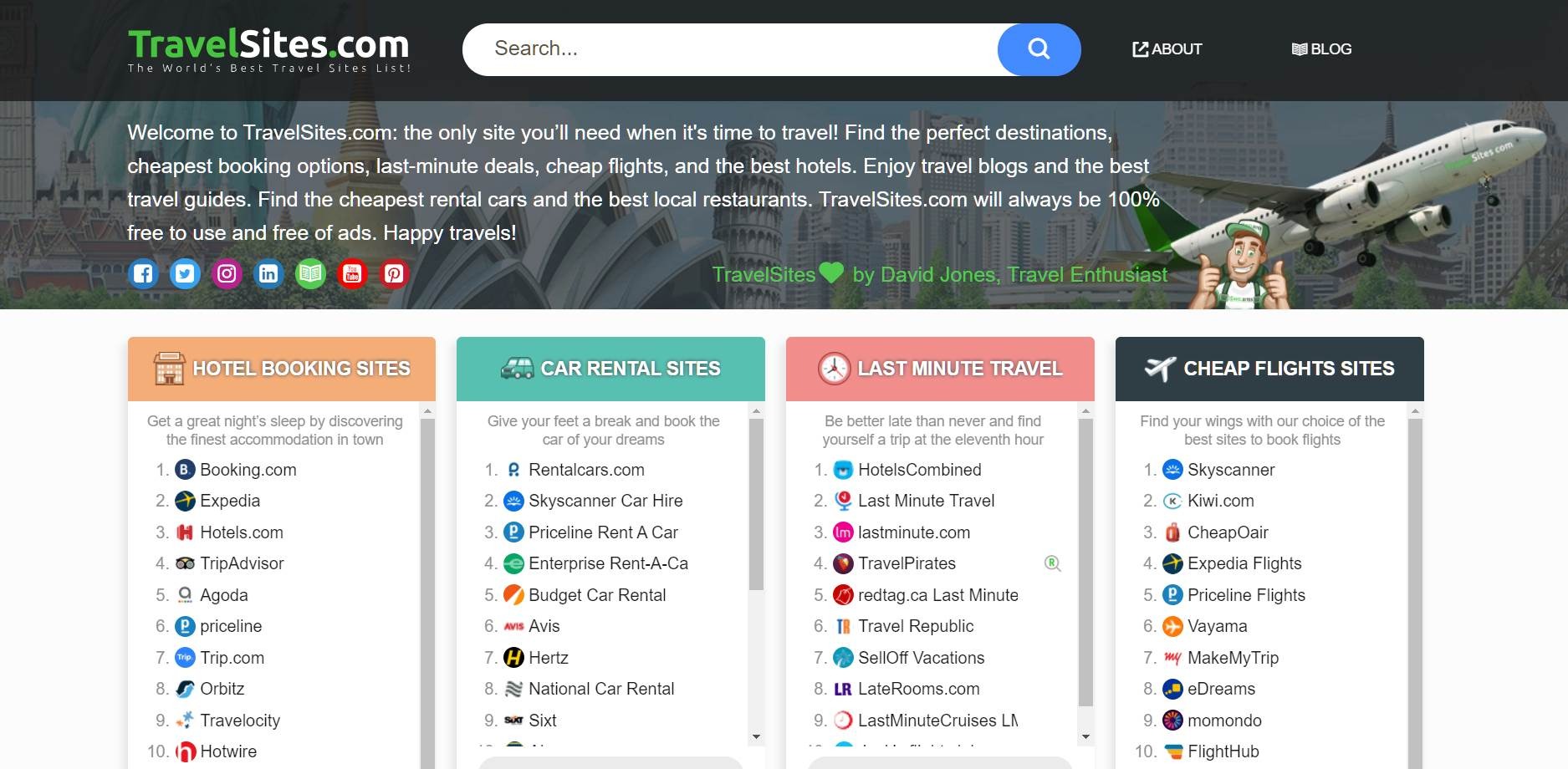

I am a professional travel writer and travel enthusiast who traveled the world twice, so I am sharing my firsthand knowledge about everything related to travel and spending time abroad.

- Uses aesthetic calendar format to display expenses

- See overview of spending on dashboard

- Pro version is cheap

- Must enter all data manually

- Lack of budget-setting capability

- Customer service difficult to contact